My investing was never the same again after I discovered this. Realising the simple power of fundamental inflection points started me on a journey toward a new (and thus far, fairly successful) investment approach.

Some lingo

But first, let’s get clear on what we mean by a fundamental inflection point. The Investopedia definition will suit us fine:

An inflection point is an event that results in a significant change in the progress of a company, industry, sector, economy or geopolitical situation and can be considered a turning point after which a dramatic change, with either positive or negative results, is expected to result.

To be super clear, we are talking about changes in the fundamental cash flows of the business, not ‘charting’ share price changes.

There are many types of fundamental inflection points. Here are just a few of the types I like to look out for:

- Turnarounds (with a major catalyst sparking the revival)

- A new fast growing product/segment, ideally whose early growth has been hidden by a larger flat or declining segment

- A major demand side break-through such as a new distribution agreement

- Growth company tipping in to profitability (with strong operating leverage)

- Hyper growth company that has has just ‘crossed the chasm’ (a topic for another update)

- Corporate spin-offs

All of these have one thing in common, which is a very rapid rapid acceleration in the rate of improvement in fundamental performance.

Today I’ll talk through just the corporate turnaround example, as it is where I first got started as a value investor.

Turnarounds

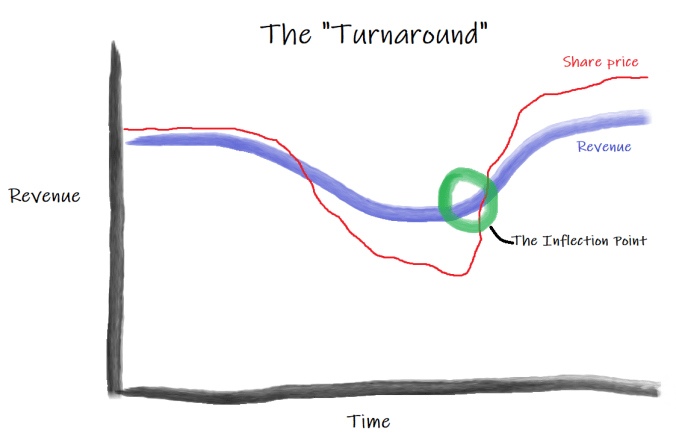

Imagine a company that has been generating steady revenue and profit when it suffers a setback and its performance takes a dive:

There can be a thousand causes. It could have been: a failed product launch; a botched acquisition; or a newly assertive competitor. Revenues slump, and profits plummet.

But whatever the cause, in this example, the declining business finally gets its act together and makes a rapid recovery. Note that this only occurs when there is a specific cause of the slump that can be quickly rectified.

The share price response to both the slump and the recovery is normally exaggerated. Here’s the typical share price moves we’d see in this situation:

This simple chart sums up a lot of ‘classic’ value investing.

Value investors look for businesses that have had some fundamental setbacks (the dip in revenue and profit). But more importantly, they are looking for situations where the market has over-reacted to the bad news (the share price plunge) and the shares are undervalued. They purchase shares during the troughs of the market’s despair and hope to sell later, when the market’s mood has improved.

For many years this was my investing modus operandi: buy something cheap, usually watch it continue to get cheaper, finally (hopefully) a rebound arrives, sell.

For many years this was my investing modus operandi: buy something cheap, usually watch it continue to get cheaper, finally (hopefully) a rebound arrives, sell.

It can be painful. Value investors are cursed with being early. That means suffering through significant further price falls before the company’s performance improves. Classic value investing doesn’t really have an answer to this painful process, aside from developing the stomach to hold your nerve (always good advice).

And that is actually the best-case scenario.

“Turnarounds seldom turn” — Warren Buffett

In plenty of cases the turnaround never comes. The traditional value investor is left holding the bag on to a company that looks cheap, but where performance continues to decline. The ‘cheap’ often just keeps getting ‘cheaper’. This slow-motion train wreck is known in the industry as a value trap.

But what if we could cut out most of the pain of suffering through falling prices, and almost all of the value trap blow-ups?

A better approach

Instead of purchasing purely based on an estimated discount to intrinsic value, we can also wait for indications that a fundamental improvement is already well under way. We can wait for the fundamental inflection point:

By waiting until the inflection point has already started we avoid the worst of the losses that long-term holders have suffered. In turn we also miss out on some of the gains, since we are unlikely to be buying at the absolute bottom. But that also means we join in just when the fun is really getting started.

Most value investors arrive for the party two hours early and make awkward chit-chat with the hosts over a bowl of dip. We arrive a half-hour late, a couple of other guests have already arrived and the conversation is flowing. Soon the party will be in full-swing. Later on, when Mr Market has gotten drunk and starts making a scene, we’ll make a polite exit.

Here is a zoomed-in version:

My preferred spot is to wait until *after* there is already some compelling evidence that the company has hit an inflection point (the black line). This has the added benefit that we rely more on observation of the world as it currently is, than solely on forecasts of how it could be in future.

When executed well, this focus on inflection points can radically enhance our expected returns:

- Reduce the number of severe ‘value trap’ blow ups. This helps us win big, lose small.

- Reduce behavioural biases: less pain from holding falling shares means less temptation to sell at the worst possible time.

- Shorten the average holding period. This is a key part of generating high annualised returns i.e. it is better to make 50% in six months than to wait two years.

- Higher ‘hit-rate’ which allows greater concentration i.e. the number of profitable trades as a percentage of all trades increases.

So why isn’t everybody already doing it?

Why it works (a.k.a. why it’s hard)

Thankfully, there are several challenges to successful inflection point investing.

First: anchoring. “I’ve missed it” are three of the most dangerous words in investing.

By the time the inflection point is already underway, the share price has likely rebounded off its lows. Investors that have been watching the stock often anchor to the lows, instead of reassessing the current value. They avoid buying, thinking that they have missed the gains.

Second: cognitive biases. The changes that happen at inflection points tend to be extremely rapid. We humans are not great at exponential thinking.

Our brains evolved to be very good at linear forecasting. That lion is running towards me. I predict that if this continues I will be his lunch. I better do something. That is very helpful linear forecasting. But it is less helpful in the modern world of finance.

When it comes to forecasting rapid change, our brains are slow to adapt. The market tends to forecast based on a linear extrapolation of recent results:

The market repeatedly under-estimates how quickly the company will improve. Then finally, the market actually overshoots to the upside. The stock then becomes overvalued. Smart investors sell, and the whole glorious cycle of expectations can start again.

Third: the search is hard work. No one rings a bell to tell you an inflection point is underway.

Small-cap and micro-cap companies are often a good place to look for these opportunities. Often nobody else is watching closely. Or more precisely, nobody else that is managing enough funds to move the price.

In these ‘under-followed’ cases it is often possible to identify the inflection point simply by following the company’s latest financial reports. But it is not always that easy. Often by the time the inflection point is readily apparent in the published financials, it is already too late. Smart investors need to be doing the hard work of equity research to identify a fundamental inflection point before it is obvious in the reported results. That means digging through every piece of information about the company, it’s competitors, suppliers, customers etc. Investors also need to ensure they aren’t being fooled with a false positive. Or as Buffett calls it, a ‘turnaround that keeps on turning’. It can be an incredibly rewarding process, but it’s hard work.

Fourth: patience. Or rather, being extremely selective. It is hard enough to find a company that is undervalued. Inflection point investing means holding off, and only investing when you have found undervaluation and a positive fundamental inflection point.

Thankfully none of that is easy, or everybody would be doing it, and the magic would disappear.

Conclusion

Understanding the power of inflection points can significantly enhance a ‘classic’ value investing approach.

We’ve only scratched the surface of inflection point investing. We talked through just one example, the corporate turnaround. But there are dozens of others. In fact, we didn’t get a chance to talk about about my favourite type of inflection point (a hyper-growth company that has has just ‘crossed the chasm’). That will have to be the topic of another update!

Subscribe to receive an email when a new update is released:

Really enjoying the new blog and content Matt! A dash of whybutwhy style about it 🙂

Thanks Kevin! That is really great to hear, and high praise indeed! WaitBuyWhy is an amazing blog.

Hi Matt, any favourite examples from the recent past you can share?

Hi Tim, great question! I might go through some worked examples in a future post. Most likely that will be about growth inflection points, as ‘turnarounds’ have become less of a focus for me personally in recent years.

In terms of turnarounds, one of the best recent examples was the success of the new management team at Bellamy’s at the start of 2017. The new team were able to address the specific problems (an overstuffed channel, onerous supplier agreements, stretched balance sheet) and effect an extremely rapid recovery. The shares rallied from ~$4, to ~$20 in a little over a year. Although it is possible that it may become an example of a ‘turnaround that keeps on turning’, the impact of the new team, and subsequent rebound in fundamentals, and share price, was pronounced.

Excellent piece Matt, thanks for sharing.

Thanks Luke!

Enjoyed this post Matt and I have similar thoughts.

Stocks that are steadily falling in price now I tend to wait for a year or two. Often by then you learn more with their next results. If it’s related to a downgrade you can see if there is another cockroach lurking ahead.

You miss some hero trades of picking the bottom of course. Buying as it has been flat for a long time or already trending up often is a better entry price than when many other value investors commenced buying. I find that can help with the anchoring challenge. Don’t dwell on the returns you missed from missing the low point. Consider the time and stress you may have saved waiting, and potentially a better entry point you may have still got compared with those diving in early.

Thanks Steve! Sounds like a smart approach. Anything we can do to avoid anchoring is a win.

Very articulate and informative once again, loving the blog – thanks Matt 🙂

Great to hear, thanks Olas!

Fantastic, as always.

Thanks Caio!

Really enjoying your content Matt. Thanks for posting.

As mentioned above, I would love some examples to go along with your article as it helps make the visuals more real and gives way to modelling ideas and future application. For example: What type of drop in price is a significant dip (linked to company factors as opposed to just market opinions)?

Also, thanks for sharing the ‘haystack’ resource. I will look it up. I’d love to hear what software professional investors/traders use in their investing process with tracking stocks and making notes or records along the way? Currently my main source is google finance and my brokerage site. But I’d like a more interactive chart which could be saved and write up notes on it (or make specific adjustments to see percentages, etc.). What a ramble!

Cheers mate.

Great feedback thanks Chris! I have had a couple of requests for more worked examples, so it should be fertile ground for a future update.

Regarding portfolio tracking software, I know a few folks that are fans of Sharesight for tracking their returns.

Hi Matt

Just wanted to say thanks for the great insights you are sharing and that I am enjoying your blog and look forward to more.

Also, I’m enjoying listening to you and your 2 simian mates.

Thanks Unclewally, great to have your support and glad you are enjoying the podcast too!

Pingback: Pushpay: The Art Of the Deal | Matt Joass

Pingback: Pushpay: Where To From Here? | Rask Media

I found this ‘Inflection Point’ a year later, but superb as always Matt! Thanks for this clear demonstration of value trap avoidance technique.

Pingback: The Bizarre, Weird, and Beautifully Inefficient World of Aussie Small Caps | Matt Joass

Pingback: How To Avoid the COVID19 Thinking Traps | Matt Joass

Great read. I feel this is particularly relevant for Appen currently. Thanks Matt!

Hi Matt. I have just published some notes where I reference your ideas on inflection points. If you have issues with this, I am happy to bin it. I have started writing these notes as a way of sharing finance ideas with (two) friends. Here is the link: https://justpaste.it/7zrjc